Military Pay Stub - The Bi-Weekly Earnings and Leave Statement provides a breakdown of the employee's gross pay and bi-weekly deductions for the pay period and the accrued amount for the tax year. It also provides individual YTD annual leave status for leave year and accrued pension deduction.

The statement is generated each pay period and is made available to the employee through the PPE and can be sent in special circumstances. It is made available to Agencies via the RPCT Reporting Center.

Military Pay Stub

The following provides an explanation of the items found in the statement. All or a combination of items may appear on the statement depending on type of appointment, salary level, prior Federal or Trustee service, tax and exemption status, benefits, deductions, contributions and categories pay and leave.

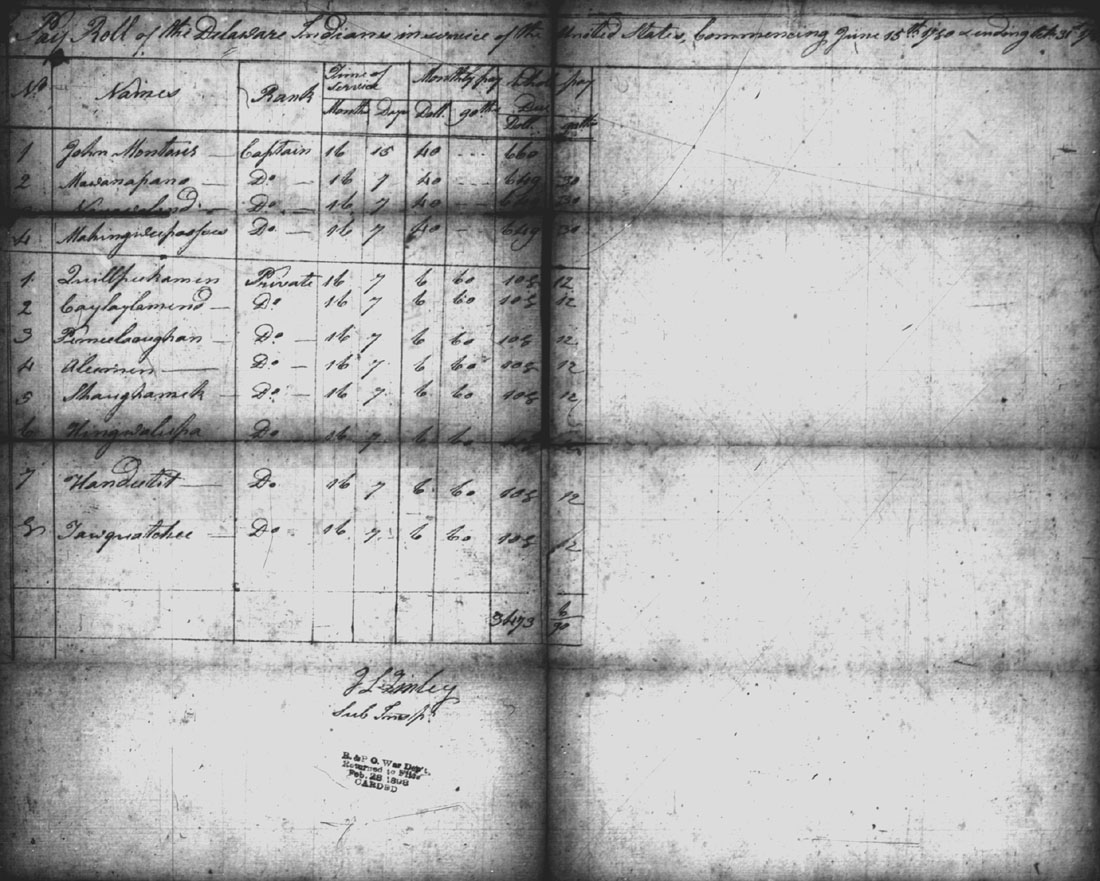

Average Regular Military Compensation By Rank

Displays the start and end dates of the payment period in the format month, day and year (MM, DD, YYYY) as they appear in the table 028 of the management system of the TMGT tables, Period and date of payment associated with the 'year.

Indicates the number of pay periods covered by the statement as it appears in the Payroll/Personnel Information System (PINQ) program PQ032, List of Salaries.

Displays the employee's point of contact number as it appears in the IRIS Information System/Search Program IR124, Address/Verification Information.

Displays the accounting station where employee salaries and related expenses should be reported as they appear in the IRIS Information Systems Program / Research IR101, Payroll Data.

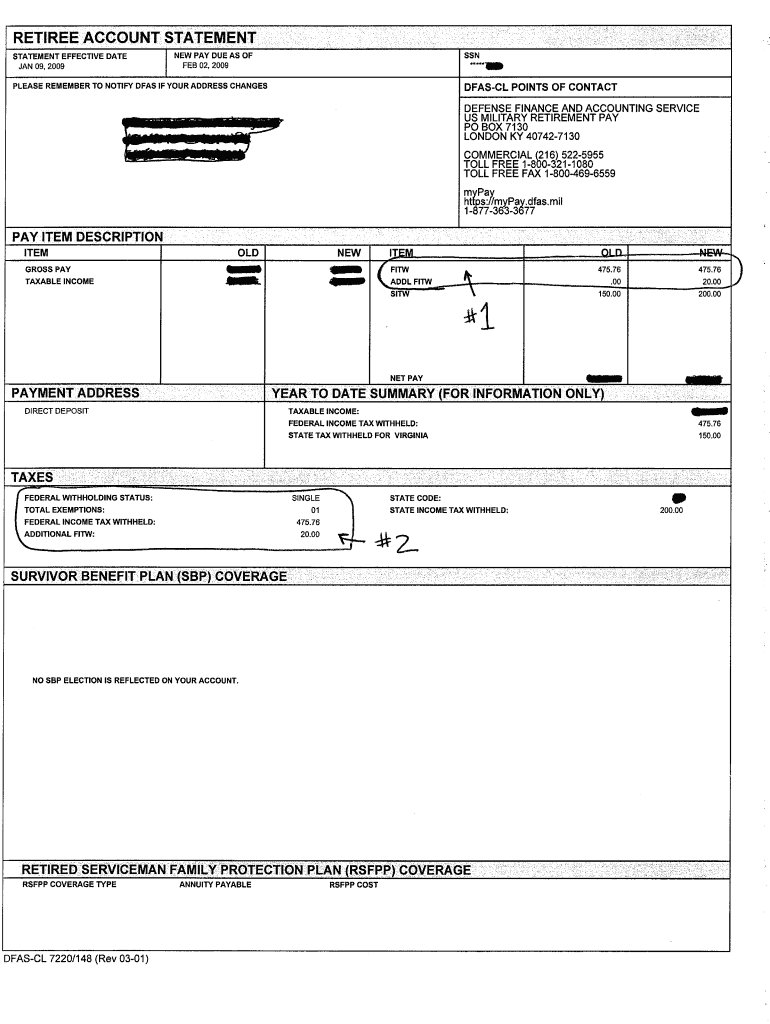

Defense Finance And Accounting Service > Retiredmilitary > Manage > Ras > Understandpage1

Indicates the organizational structure code to which the employee is assigned at the fourth level as it appears in IRIS Information / Research Program System IR101.

Displays the ID of office staff responsible for personnel management and other work-related matters for this employee, as reported in the IRIS IR101 Information System/Research Program.

Displays the compensation plan that applies to employees as it appears in IRIS Information / Research Program System IR101.

Displays the grade as provided in the compensation plan for the employee's position as it appears in the information system / research program IRIS IR101.

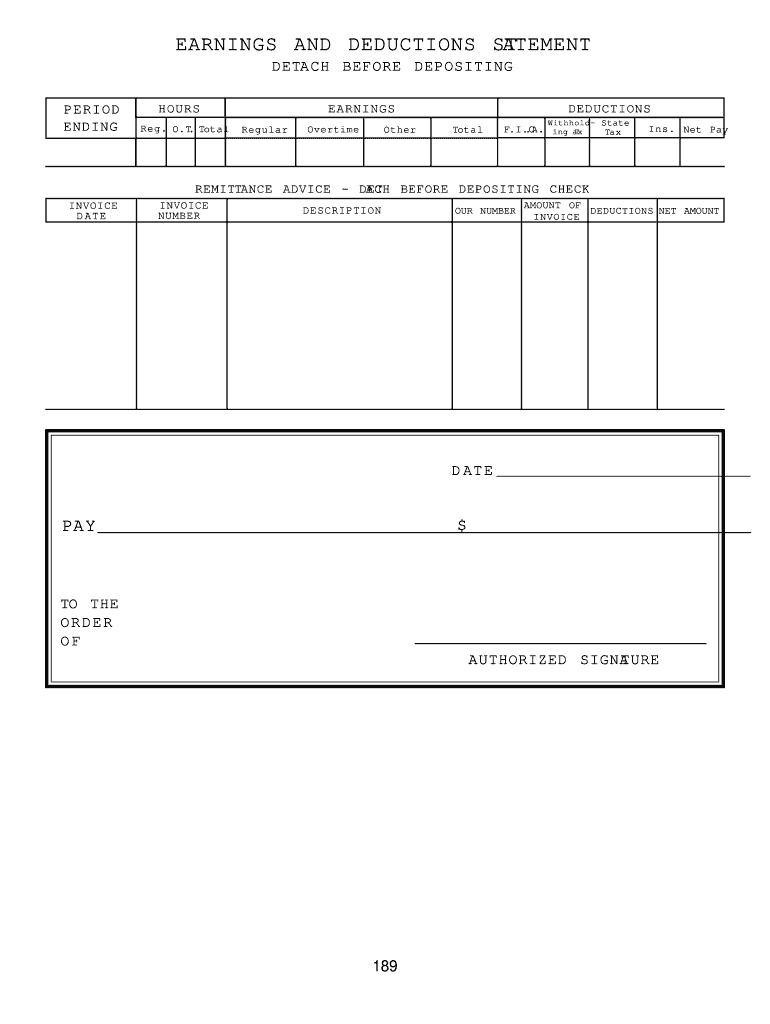

Statement Of Earnings And Leave

Indicates the step in the grade as provided for in the salary plan of the employee position as it appears in the IRIS Information Systems Program / Research IR101.

Displays the employee's adjusted annual salary as it appears in IRIS Information / Research Program Research System IR101, consisting of the annual base salary level and locality comparability payments for the current year. Administratively Uncontrollable Overtime (AUO), payroll availability, and availability payroll amounts are obtained from the payroll processing system (PAYE) in the current pay period.

Displays the employee's service calculation date (SCD) for leave as it appears in the IRIS Information/Research Program search system, IR122, SF-50B data elements.

View employee retirement deductions for the current appointment as they appear in IRIS Information / Research Program System IR117, Retirement data.

What Is An Itemized Wage Statement & California Labor Code 226?

The transaction code for each item as it appears in the TMGT Table Management System table 032, Transaction Code. Valid codes and descriptions are listed in the Codes and Descriptions table below this table.

Description of the transaction codes for each item as they appear in the system management table 032 of the TMGT table. Valid codes and descriptions are listed in the Codes and Descriptions table below this table.

Shows the number of work hours and the number of vacation hours used in each category during the pay period.

Shows the number of work hours and the number of vacation hours used in each category since the beginning of the year.

How To Use Mypay

Shows the monetary amount of hours worked and time off used in each category during the pay period.

Displays the gross payroll amount for the pay period as it appears in PINQ Payroll / Program System Inquiry Personnel PQ032.

Indicates the number of years of gross salary to date as shown in IRIS Information / Research Program Research System IR103, Salary YTD year-to-date Data.

Displays the net pay amount for the pay period as it appears in PINQ Payroll / Program System Inquiry Personnel PQ032.

Army To Switch All Active Duty Soldiers To Semimonthly Pay Oct. 1

View the hidden routing number of the financial institution where the employee's net pay is stored as it appears in IRIS Information / Research Program System IR124.

Presents comments designated by the employee organization or the NFC National Financial Center to notify employees of changes in statements or relevant information.

Displays the employee's name and address as listed in the IRIS Information System Program / IR124 Search.

Below is a list of transaction codes that may appear in the Statement of Earnings and Leave :). This square is filled with a bunch of blocks that quickly start running together. But these blocks constitute a complete accounting of your income and your rights. Understanding what they mean can help you spot errors that, if left unchecked for too long, can cost you time and money.

Military Pay Information & Resources

The Leave and Earnings Statement (LES) is a comprehensive statement of your military pay. This is a military pay stub that includes your pay stubs, deductions, tax deductions, and other entitlements. Your latest LES can be found in your MyPay account.

You'd be surprised at how well my department members help solve financial problems caused by ERP errors. Finding out that you have no down payment will definitely throw your life and your monthly budget into chaos. I don't knock at DFAS, but mistakes do happen - humans are working on it. This is why it is so important to check your LES often. This will help you find and fix problems sooner. Here's what you need to know about your LES.

Your LES is your military pay statement. This is the military version of a pay stub or payslip. It tells you how much money you earn during the pay period, the amount of tax withheld, your leave balance and much more. It is basically a detailed report of your salary and benefits. It usually comes out a few days before each payday to let you know your current time off and earnings for the pay period. Reviewing your SAE is an important part of your monthly money management.

An LES has 78 fields. Yes, you read that right. There are 78 blocks in LES that you need to know and understand. You don't have to memorize everything, but you should become familiar with your LES to recognize problems. Your LES field is divided into 11 main sections which are:

Military Pay Dates

4. PAY DATE: The date you entered active service in YYMMDD format (also referred to as Pay Entry Base Date).

6. ETS: Expiration of your period of service, better known as the date of separation, written in the format YYMMDD.

9. PERIOD COVERED: This LES pay period generally includes one calendar month unless they are separated.

10. ENTITLEMENTS: This is a list of all your entitlements and allowances paid such as base salary, BAS and BAH.

Military Payroll Tax Deferral 2021 (what You Should Know)

11. DEDUCTIONS: This is a list of all deductions from your pay such as taxes, SGLI and mid-month pay.

12. ALLOCATIONS: This is a list of all deductions such as transfers to your savings or rent payments. It also lists your non-discretionary allowances such as child support.

17. = NET AMT: This figure is the result of taking all of your wages and allowances and deducting all of your deductions and allowances for that month.

18. CR FWD: If yes, this is the amount of unpaid wages and allowances owed to you. The dollar amount will represent your next LES as +AMT FWD.

Military Pay Dates And Early Pay Usaa & Nfcu · Military With Kids

19. = EOM PAY: This is the magic number everyone is looking for. This is the amount of salary you receive on the month-end payday.

23. DIEMS (First Date Entered Military Service): Your DIEMS is only used to determine the pension plan to which you belong. The date is from your personnel command, not DFAS.

24. RET PLAN: This field will show your retirement plan categorized under (Final Pay, High 3, REDUX or BRS).

25. BF BAL: It stands for “carried over leave balance”. Your leave balance at the beginning of the fiscal year, or at the start of your active service commitment, or the day after the payment of the lump sum leave (LSL).

Form Dfas 702 Fill Online, Printable, Fillable, Blank

26. ERND: You earn 2.5 days off per month. This field shows the total number of vacation days you have earned for the year.

28. CR BAL: Most service members and their spouses oversee this number. Your current leave balance at the end of the pay period for the Leave and Earnings Statement-LES.

32. USE/LOSE: Also known as "make or lose". This is the number of vacation days you will lose if you do not use them in the current fiscal year.

34. Earnings Year-To-Date: Your total earnings for the year to date that are subject to federal withholding tax. Payments such as Basic Housing Allowance (BAH) and Basic Living Allowance (BAS) which are not taxable will not be included in this number.

What Does This Mean On My Pay Stub? (roc)

36. EX: The number of exemptions you can claim for tax purposes. It is also used to calculate your FITW.

39. SALARY PERIOD: The amount of your earnings for the pay period that is subject to the Federal Insurance Contribution Act (FICA).

41. SOC TAX YTD: This is the total amount of FICA that was withheld from your pay for the entire calendar year.

45. SALARY PERIOD: The amount of your earnings for the pay period that is subject to state income tax (SITW) withholding.

What Is Payroll Tax?

52. VHA ZIP: If applicable to you, postal code is used

Real pay stub, free pay stub app, military pay stub codes, what does bas mean on a military pay stub, best pay stub generator, bas on military pay stub, pay stub software free, pay stub creator, real pay stub generator, payroll pay stub generator, les military pay stub, pay stub

0 Comments